Throughout the Hurtsboro loans Stefanie

Stefanie first started the lady occupation due to the fact a journalist, reporting on the possibilities, futures, and you may retirement finance, and more than has just did due to the fact an author and you may Search engine optimization blogs strategist from the an electronic purchases company. In her own free-time, she provides practise Pilates and you will spending time with this lady girl and you can Siberian Husky.

Owning a home are a method. Most homebuyers you should never shell out dollars because of their land, so they really need to take away a home loan making money for many years prior to they can state they own it outright. Each of men and women repayments helps make guarantee, the percentage of the entire worth of the home that buyer controls. One collateral was an asset.

Property guarantee loan is actually a guaranteed financing the spot where the equity ’s the collateral the house buyer has generated up-over go out. Domestic collateral loans usually are taken out to do home improvements or perhaps to make it through hard monetary activities. They’re able to also be employed to possess debt consolidating. In this post, we’re going to define just how that works and you will be it a good idea.

- Is actually house security money perfect for debt consolidation reduction?

- Masters of employing a home collateral loan having debt consolidation

- Cons of employing a property security loan having debt consolidation

- When a property security financing is reasonable

- When a property collateral loan isn’t smart

- Qualifying having a home security mortgage

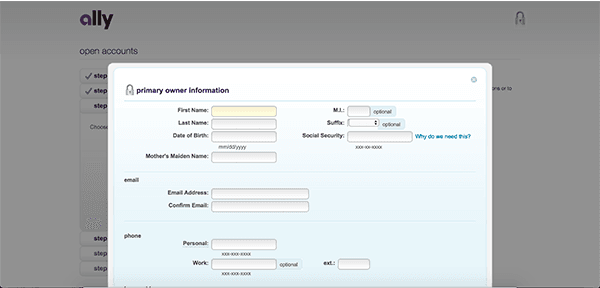

- Methods to apply for a house equity loan getting debt consolidating

- Family security financing vs personal loan getting debt consolidation reduction

- HELOC to have Debt consolidation

Are household guarantee funds perfect for debt consolidation reduction?

Debt consolidating means reducing rates. Bank card rates was large. Household collateral financing interest rates are generally all the way down, as they are secured finance, than other loan affairs, together with focus payments are tax deductible. That makes this type of loan useful for combining large desire personal credit card debt and you can streamlining expenses.

You’ll discover positives, however it is also important to understand the risks. Credit against your property leaves the home vulnerable to foreclosures if you can’t build your costs. Mindful economic believe is always to predate people try to pull out an effective house equity financing. A keen unsecured consumer loan could well be a better solution, regardless if rates of interest is high.

Various other issues having home equity money is the fact assets thinking you are going to get rid of from inside the longevity of the mortgage. This may improve homeowner becoming upside-down and you will owing more than your house is worth. Fees terminology for the domestic security funds should be a decade or offered, therefore property beliefs are likely to change. View industry projections before you act to find out if they truly are attending increase.

Gurus of using a house collateral mortgage having debt consolidating:

Rates of interest into the house equity finance tend to be lower than almost every other particular financial obligation, for example handmade cards. For the reason that home security funds was secured loans, and thus you’re providing collateral to your bank.

House security financing typically have prolonged installment periods than other versions out of loans, so that your monthly obligations would be reduced.

In lieu of worrying all about payment dates and repayments having multiple debts, you’ll be able to only have to love paying that four weeks.

The attention is going to be tax deductible in the event your loan is regularly change your house’s value we.age. building an extension or remodeling the kitchen. Whatever else the mortgage is employed to own may not be deductible.

Due to the fact you might be providing your property as the guarantee toward bank, your perspective less exposure toward bank and generally speaking don’t require a brilliant large credit history to help you qualify. However, high results will normally accommodate better interest levels.